SQM’s Role in Global Markets

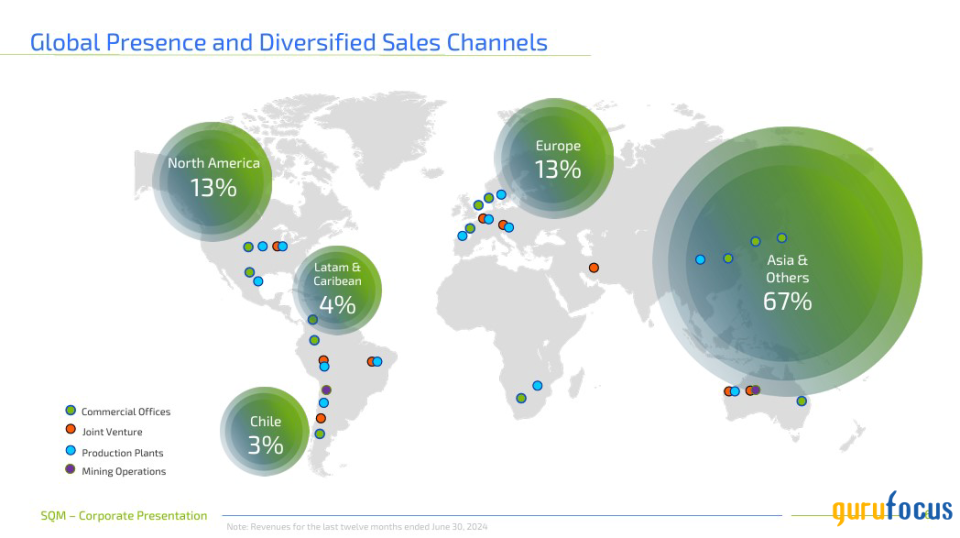

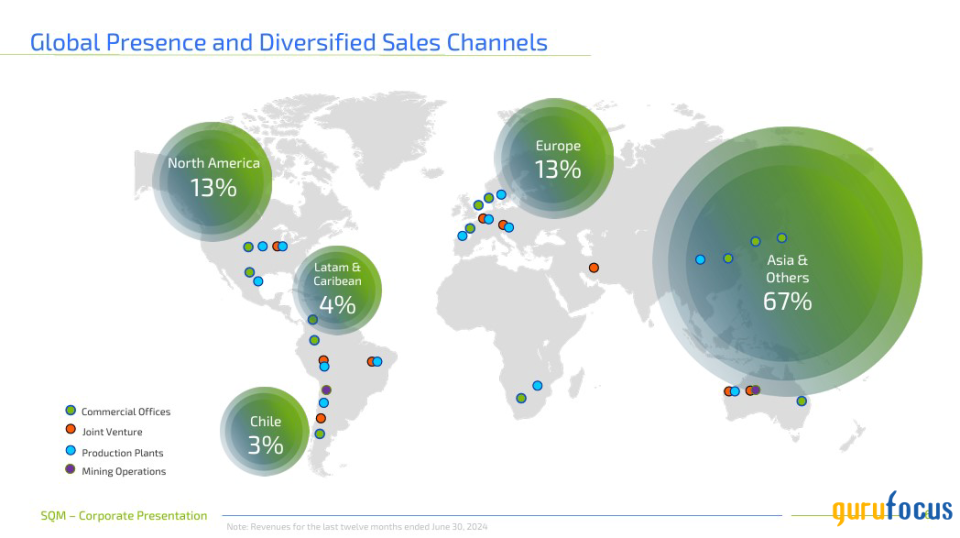

Sociedad Quimica y Minera de Chile S.A. (NYSE:SQM), based in Chile, has established itself as one of the world’s leading producers of lithium, iodine, and potassium derivatives. Their global sales and production presence is spanned across multiple continents, with numerous Commercial Offices, Joint Ventures, Production Plants, and Mining Operations across North America, Europe, South America, with the bulk of sales being generated from Asia, and Oceania.

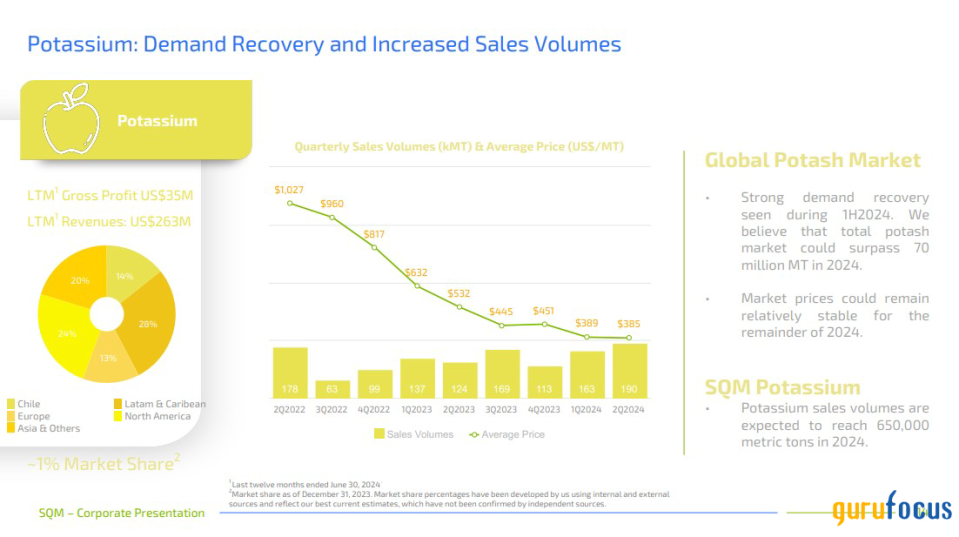

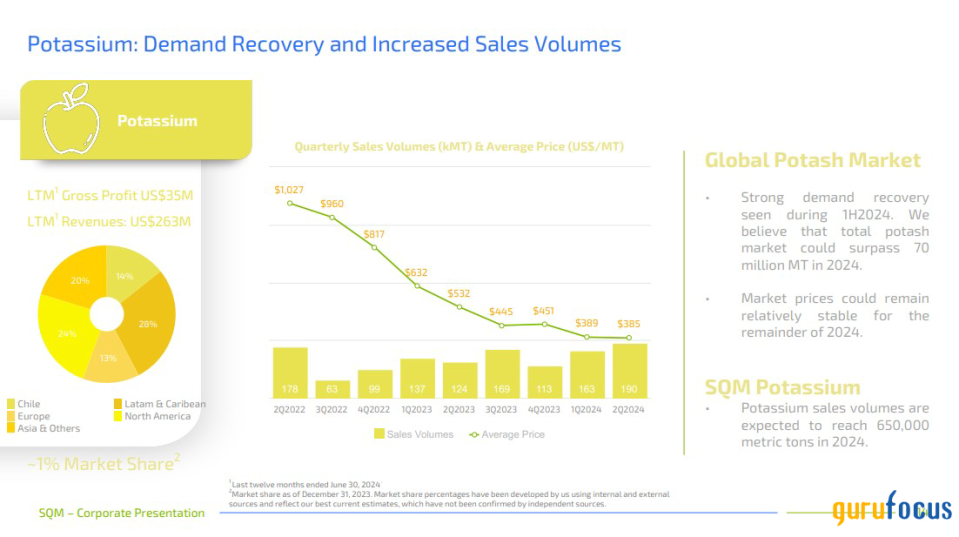

Among their products it is worth clarifying that the potassium-based products are key to the development of fertilizers that support agricultural productivity worldwide.

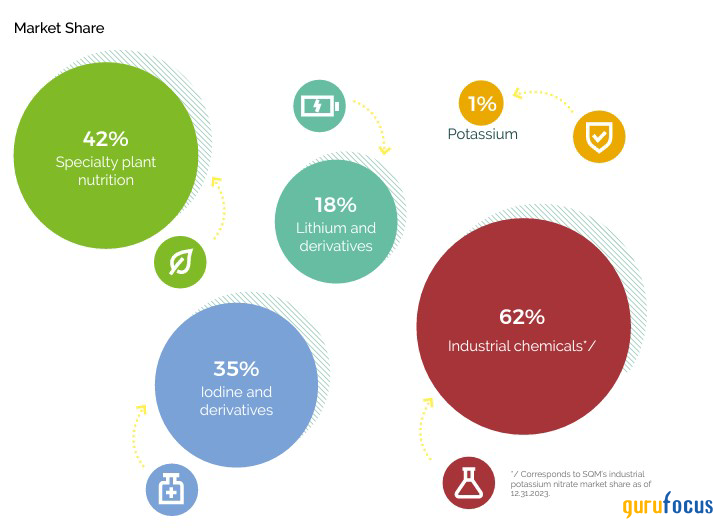

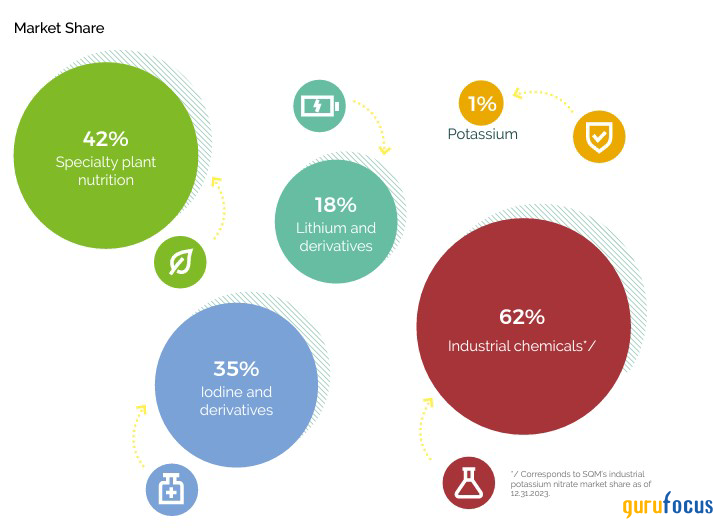

While their overall Potassium global market Share may only be 1%, this figure turns out to be a misleadingly mainly due to the fact that this segment includes Potassium Chloride, with SQM only accounting for 1% of the global share when compared to their hyper-specialized Potassium Chloride producing competitors taking up a much bigger share with higher volumes: Nutrien, 21%; Uralkali, 15%; Belaruskali, 10% and Mosaic, 13%; therefore diluting SQM’s global Potassium Share as a whole.

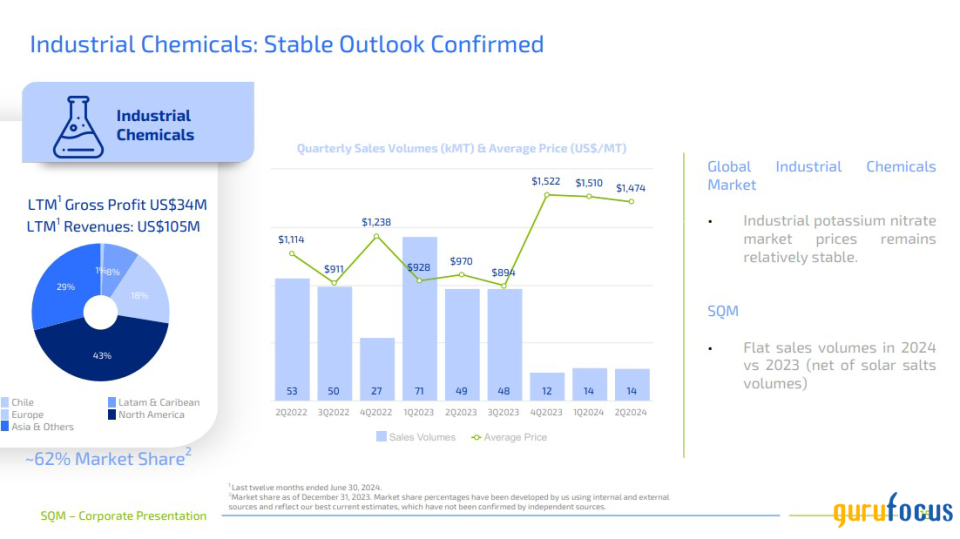

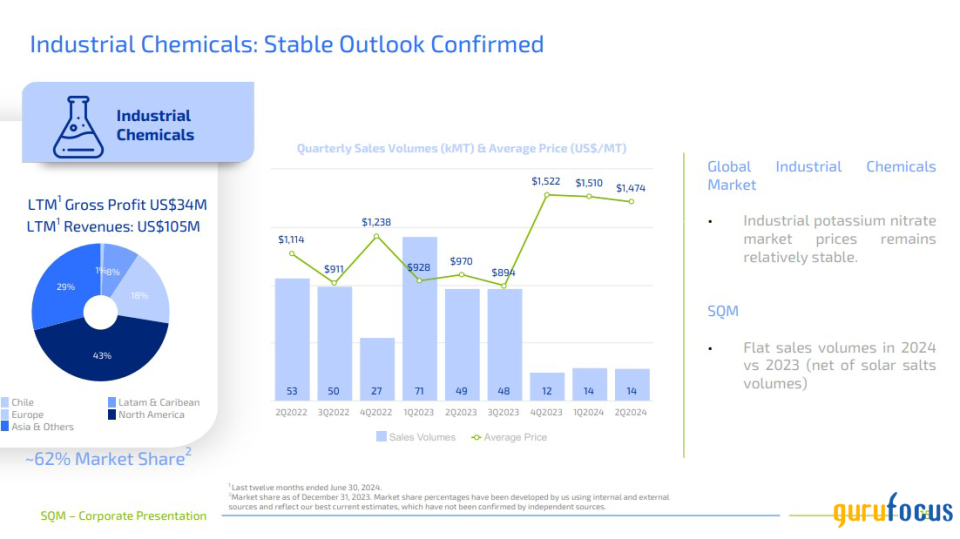

Despite SQM’s lower market share within this segment, SQM’s potassium production contributes greatly to their overall Industrial Chemicals, (IC) and Specialty Plant Nutrition, (SPN) segments which respectively make up 62% and 42% of the global market share largely due to their heavy presence in production of, and the global demand for Industrial Potassium and Sodium Nitrate products, which they accounted for 62% and 44% of the Global Market Share respectively in accordance to the breakdown provided in SQM’s 2023 Sustainability Report.

These sodium and potassium nitrate products are dual purpose as they not only act as key ingredients of fertilizers, pesticides, and preservatives, benefiting their SPN segment, likewise, these nitrates drive their IC segment primarily attributed to demand for Thermo-Solar Salts, a molten salt used by Concentrated Solar Plants, (CSPs) to power their turbines and produce energy.

This process works by taking solar radiation and concentrating it onto an array of mirrors which are then focused onto a central tower where the salts are stored, this heats up the salts to a molten state which then produces the steam required to drive the turbines and produce electricity. Molten salts are in high demand for this use-case due to their excellent ability to withstand high temperatures without breaking down paired with their excellent ability to both absorb and transfer heat. This makes them an ideal choice not only for steamgeneration in CSPs but also as coolants for Nuclear Molten Salt Reactors.

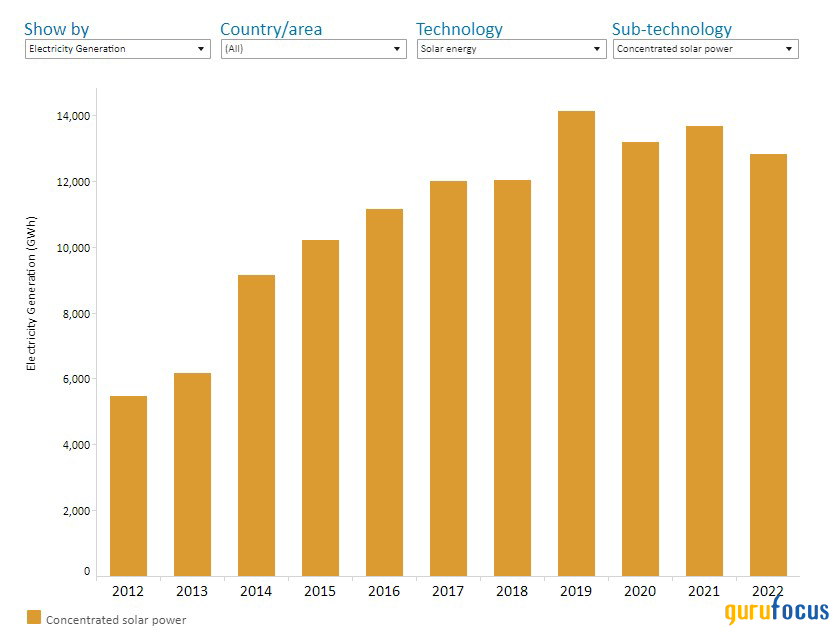

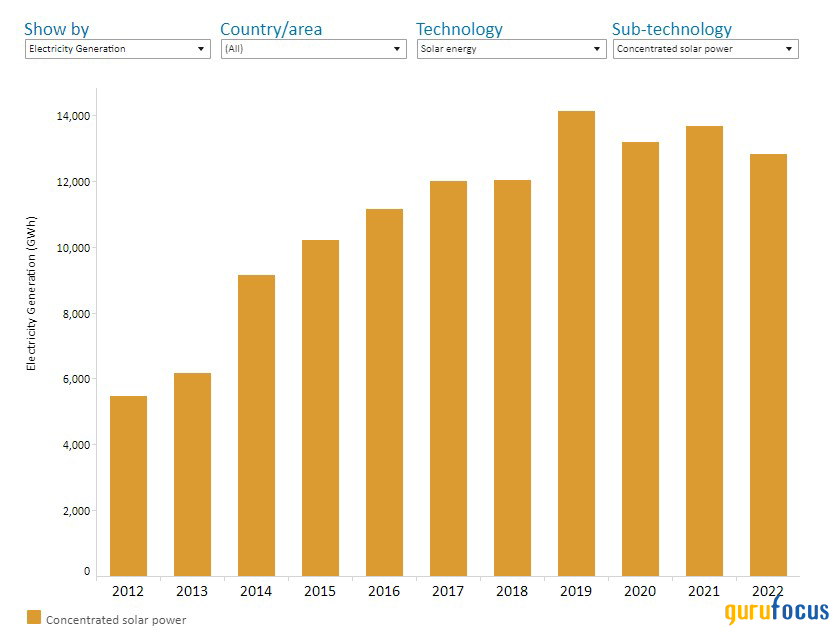

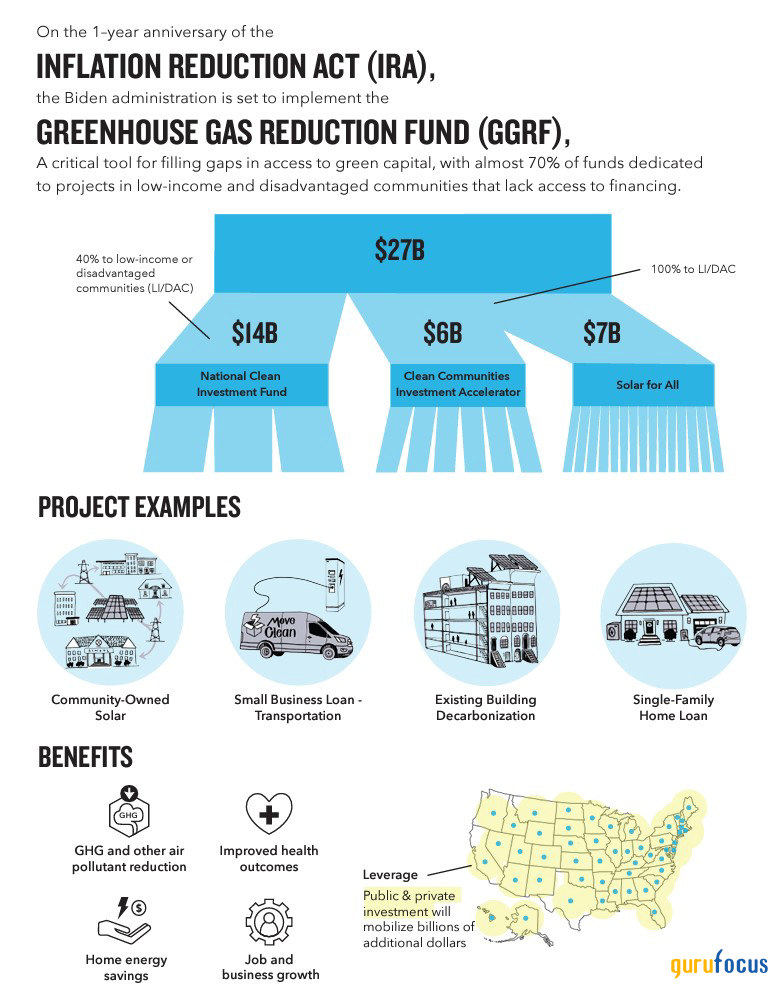

In recent history there has been an international initiative to fund green energy projects. Among those, CSPs projects have benefited greatly from this funding and has significantly contributed to the trend of YoY increases in Concentrated Solar Power electricity generation:

Source: IRENA

The above chart shows the YoY trends of Concentrated Solar Power electricity generation, which has seen trend of growth since 2012 that turned exponential in 2014, largely sparked by the opening of Ivanpah, the world’s largest CSP at that time, with a capacity of 392 MW, enough to power 140,000 homes.

The construction was financed with $1.6 billion in risk free loans by the Department of Energy and $300 million in Venture Capital. The total construction cost amounted to $2.2 billion and has proven to a successful venture for its owners: (NRG), BrightSource Energy, and Google. The success of this venture aligned with innovations of technology and served as a proof of concept which opened the door for many more such projects being funded in the subsequent years with Concentrated Solar Power Electricity Generation eventually surpassing 14,000 MW/hs.in 2019 where it continues to hold near today.

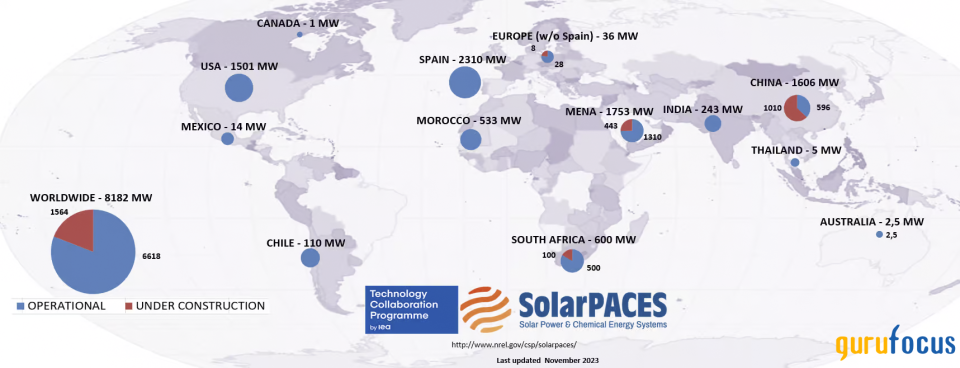

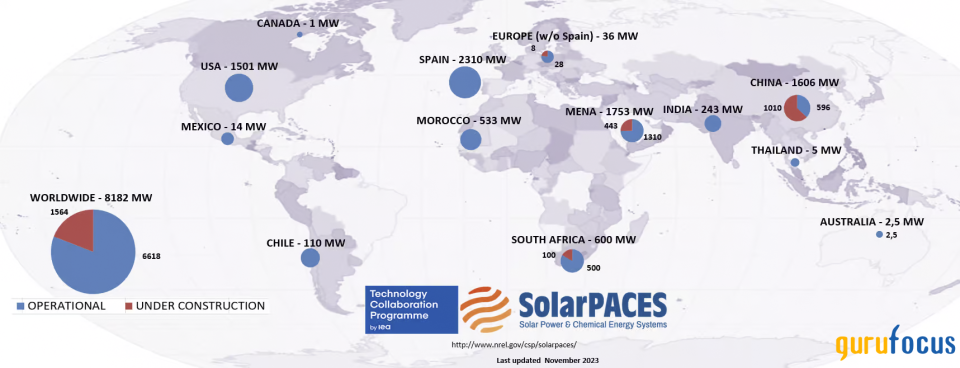

According to the IEA and SolarPACES, CSP Operational Capacity reached 6618 MW worldwide with an additional 1564 MW of capacity remaining under construction as of the end of 2023. Like with the Ivanpah project, much of this construction has been government funded and is part of an international initiative to securing a sustainable source of environmentally friendly energy.

The IEA and SolarPACES offers a project map detailing global capacity of Operating and Non-operating CSPs which I have provided below.

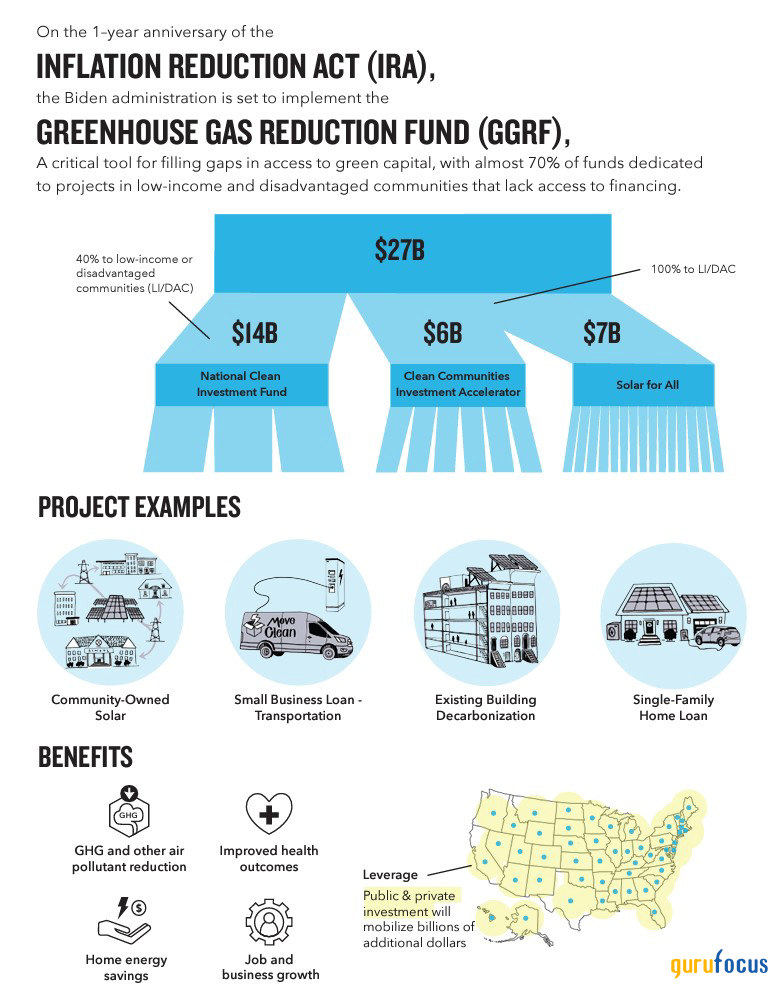

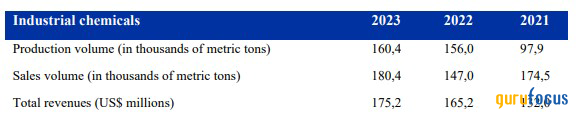

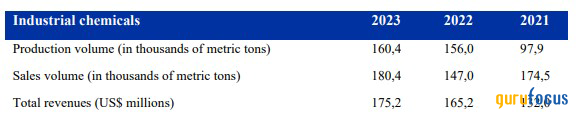

The size of the global solar salt market between 2022 and 2023 was approximately $4.5 billion, with SQM alone making up a combined total of $2.8 billion in revenue across their Potassium and Industrial Chemical segments in the year of 2023. This further illustrates SQM’s dominance within the industry and further exposes it to all future benefits and growth prospects within the global solar sector. Federal Government thus far has set aside a $27 billion Greenhouse Gas Reduction Fund (GGRF), under this fund 60 US-based nonprofits, and municipalities were awarded $7 billion under as part of Biden’s Solar For All program aimed at delivering solar to more than 900,000 low-income US households.

Source: Jessica Russo/NRDC

This government initiative is just one of many worldwide initiatives, which have continued to drive more demand for SQM’s Solar-based products, thus likely further securing SQM’s continued growth within the sector.

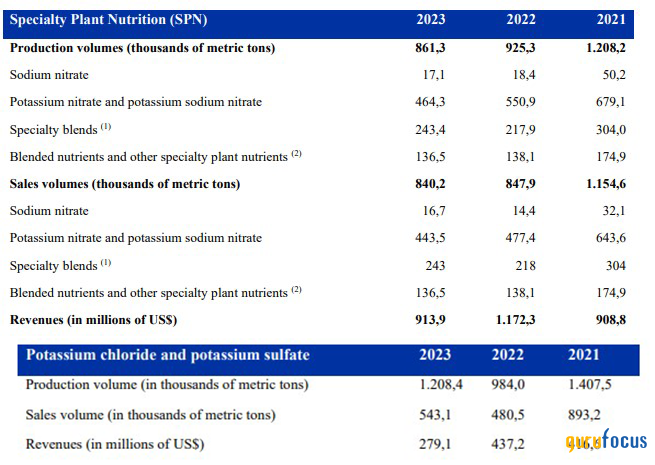

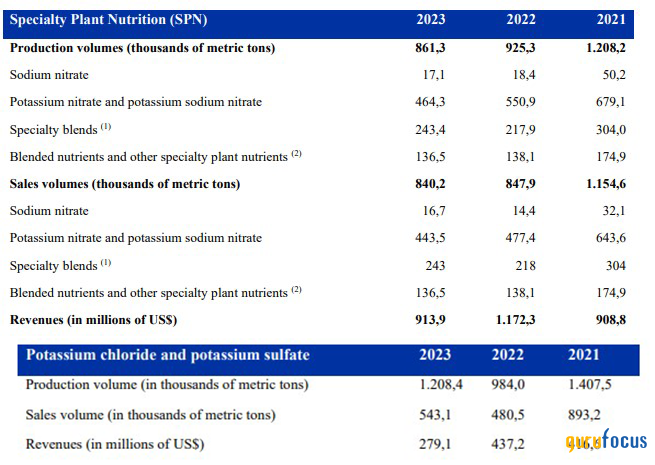

Source: SQM 2023, Annual Report

As shown in the Q2, 2024 Earnings Presentation, we’ve seen sales volume take a notable dive between 2023 and now;

Source: Q2, 2024 Earnings Presentation

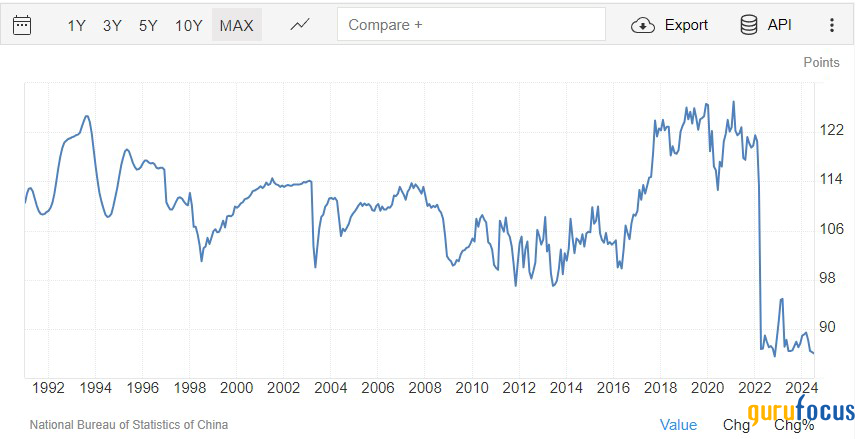

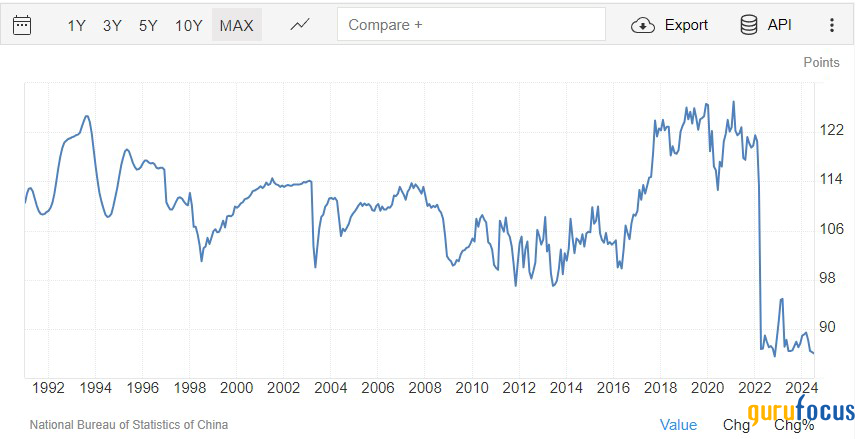

This is likely due to economic declines experienced within the Asian Markets, namely-China. In early-2021, the Chinese Consumer Confidence Index peaked at an all-time high of 127 points; this peak was followed by a sharp decline in late-2022, dropping to a record all-time low of 85.50 points, far below the happy mean of the low 100s the Chinese economy has normally enjoyed:

Source: TradingEconomics.com

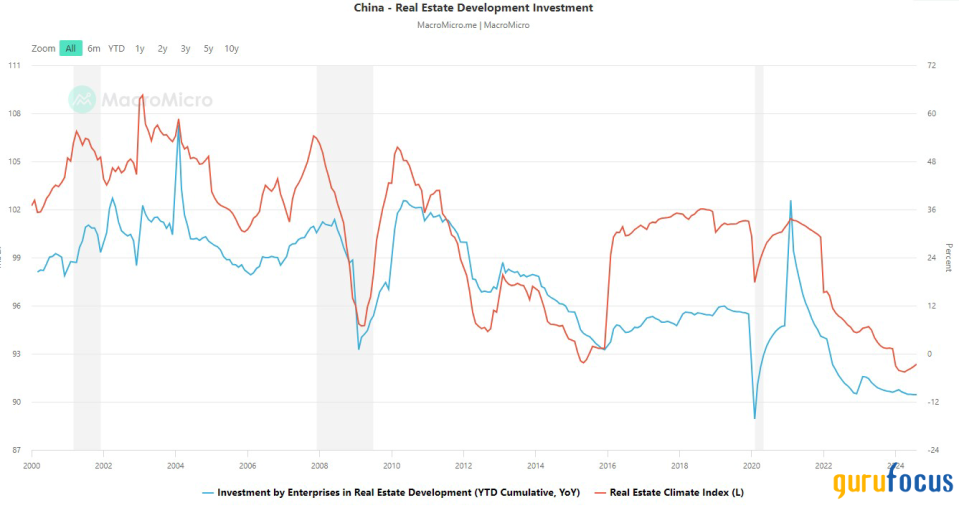

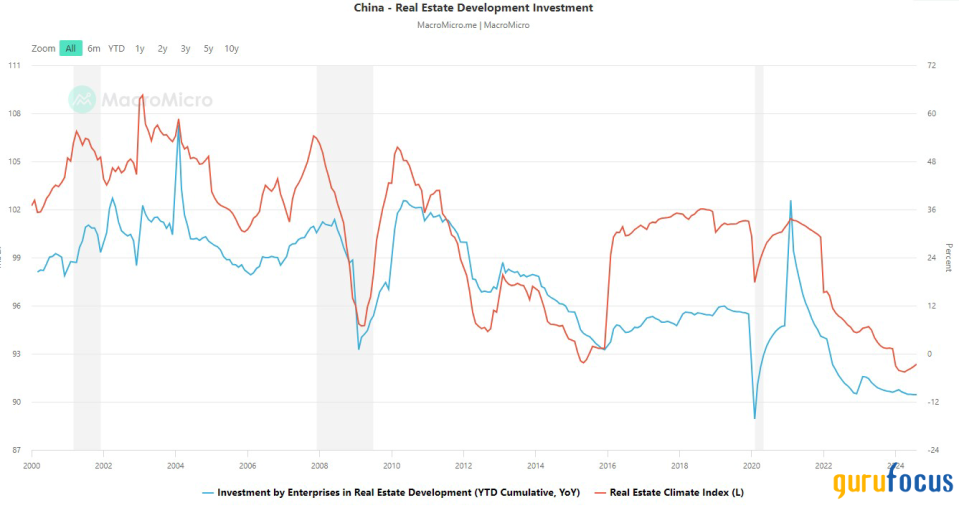

This downward shift in consumer confidence was in alignment with the collapse of Evergrande Group; China’s biggest property giant who went bankrupt and began a long liquidation process of all of their assets in late 2021, a process that has continued into the current day. This failure of Evergrande sent ripple effects throughout the property sector and resulted in Enterprise Investment within the sector falling greatly during the same period;

Source: MacroMicro.me

I suspect that it is this economic failure in China, especially within its property sector, has greatly contributed to the falling volumes the Industrial Chemicals segment has experienced.

However, it is once again worth emphasizing that the average sale prices within the IC segment have remained higher while nearly doubling during the same period, growth which has been fuel primarily by rising North American and European demand. This has allowed the company to expend less while still making a profit during this intermittent period of economic decline.

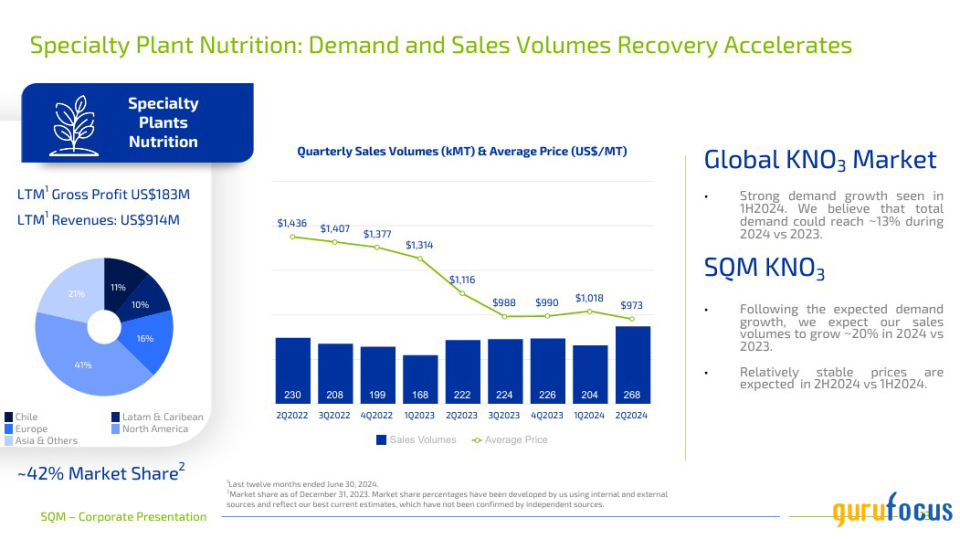

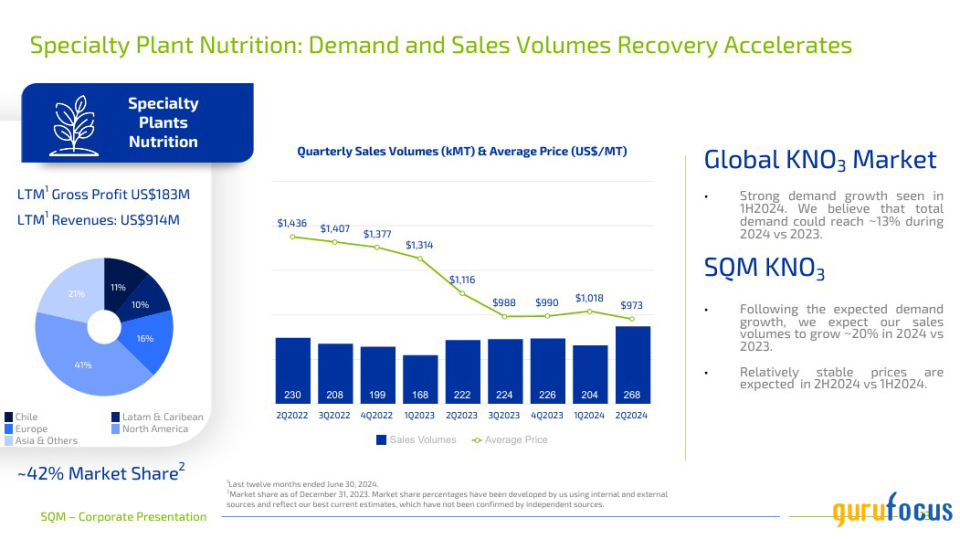

Both the SPM and Potassium Segments also experienced notable shortfalls during this time, likely driven by the decline in the Chinese Consumer and Chinese Commercial Investment.

Source, SQM 2023 Annual Report

However, it should be noted that the ongoing trend across these segments show promising demand strength in sales volumes, which is primarily due to the fact that North America and Other markets have largely stepped up to fill in for the void of demand left by the declining Chinese Markets.

This dynamic as highlighted by their Q2, 2024 Earnings Presentation, has led to exponentially rising sales volumes in both segments well into current year and has thus resulted in prices remaining stable and earnings growth being projected higher as the year of 2024 concludes.

Moving over to SQM’s Iodine segment, it is made apparent that SQM are responsible for running the majority of Chile’s iodine operations, mainly from Caliche Ore Deposits located in Northern Chile.

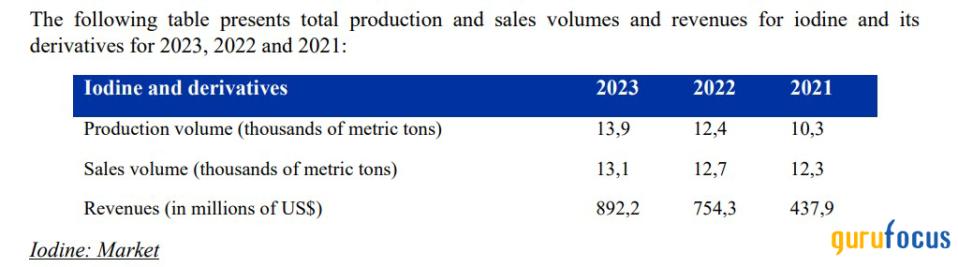

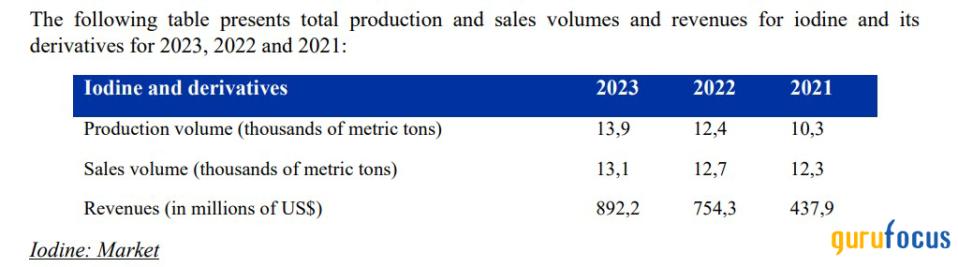

SQM estimates that it was responsible for 35% global iodine sales by volume for the year of 2023 and detailed that it produced record-breaking amounts, approximately 13,900 Metric Tons, with 13,100 Metric Tons in sales volume.

Source: SQM 2023 Annual Report

SQM’s Iodine segment spills over into various fields, ranging from being used as contrast agents for X-rays, and CT scans in the medical field, to being used in fertilizers and safe disinfecting agent at low concentrations in agricultural fields such as in iodized salts; and even in widely-used technologies such as LCDs where it is used in the production process of polarizing filters, these are used to add contrast and improve the viewing angles for LCD screens such as those used on monitors, TVs, smartphones, and other devices.

According to a 2023 survey conducted by the US Department of Interior, Chile account for about 65% of the world’s Iodine Production excluding US Production; when factoring in US production the figure still managed to be more than half. Additionally, between 2019 and 2022; 89% of US Iodine Imports were sourced from Chile. The continued exclusive support provided by high US demand has greatly shielded this segment from economic declines stimming from China; resulting in not only higher sales volumes, but higher average prices as well.

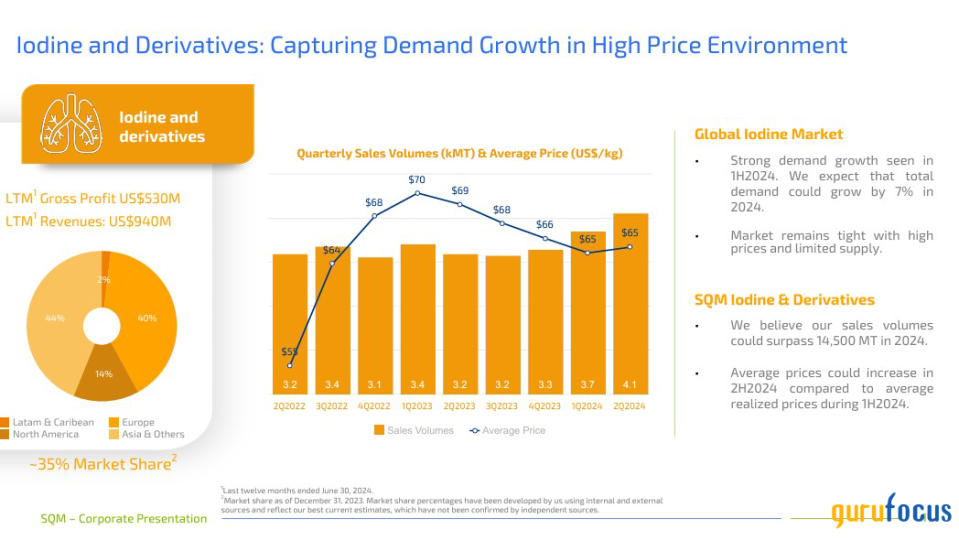

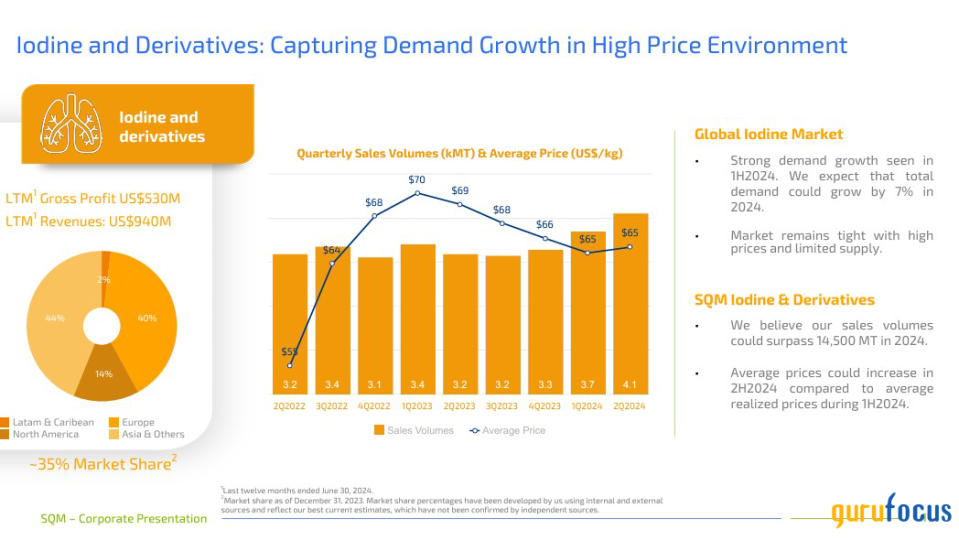

Based off the recent Q2, 2024 earnings presentation, SQM’s Iodine segment is expected to continue to see higher volumes at higher prices as the year concludes, this combination should have a positive effect on theEBITDA of the overall segment.

Source: Q2, 2024 Earnings Presentation

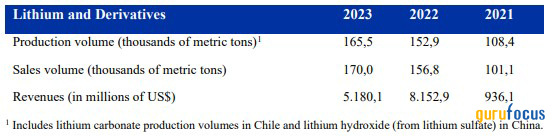

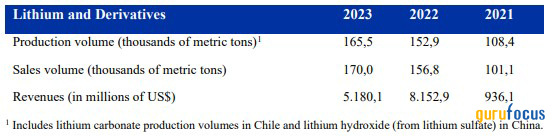

Lastly is their Lithium segment, so far the segments we have covered are those in which SQM hold majority market share, but however impressive their performance in those sectors may be still only represent just lessthan half of the company’s total yearly revenue. The core of their business lies in the lithium segment, and while the company has continued to make a profit within this sector, it has experienced significant YoY declines, falling 36.5% from the $8.1529 billion high of 2022 down to $5.1801 billion in 2023. This was mainly attributed to lower average lithium prices over the course of the year but was partially offset by record high sales volumes.

Source: SQM 2023 Annual Report

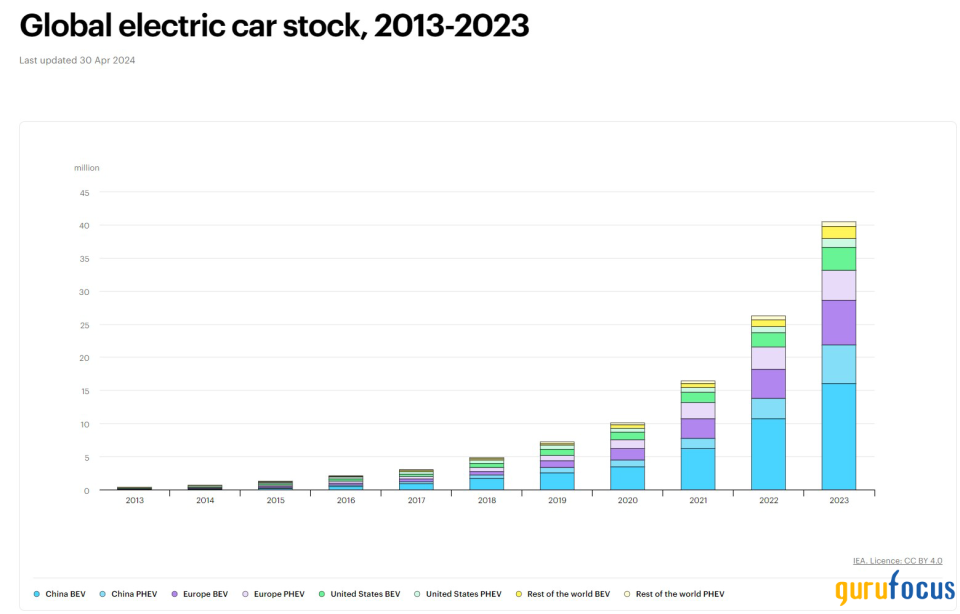

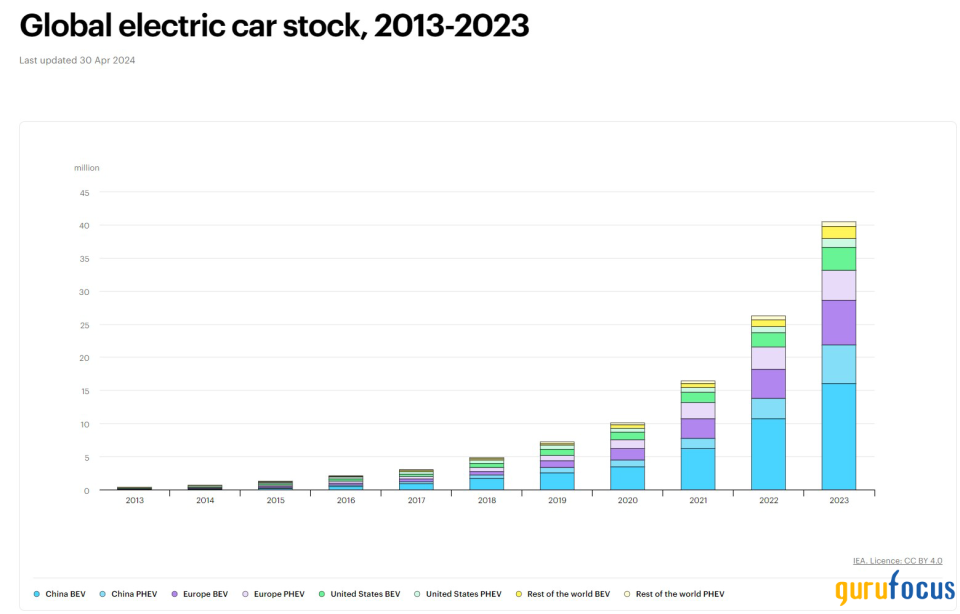

The lithium segment is one that has seen explosive demand growth over the last few years and is a great beneficiary the EV Boom, China’s contribution within this sector has been especially high with it consistently contributing to just under 50-65% of electric car registrations since the 2020 EV boom, but following China’s economic slump in 2022, we’ve seen China’s contribution to EV stocks begin to stagnate, gradually going from a trend of exponential growth, to linear growth by 2023.

This trend can be visualized in this chart of global electric car stocks provided by the EIA:

Source: EIA

In this chart we can see Chinese Plug-in Hybrid EV, (PHEV), and Battery EVs (BEVs) represented by the top and bottom blue shades respectively. While the overall global market has grown, China’s dominance within this growth has seen significant stagnation, particularly within the BEVs. This was followed by substantial declines in lithium pricing following 2022 as illustrated in SQM’s Q2, 2024 Earnings Presentation:

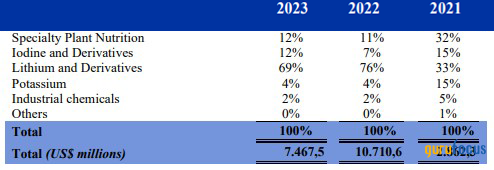

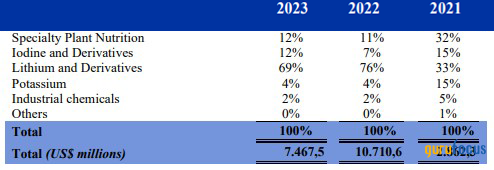

It is worth mentioning that in spite of YoY pricing and revenue declines between 2022 and 2023, both revenues and sales volumes remain at record highs compared to years prior, with revenues only reaching just under $1billion in 2021 and sales volume nearly doubling over the course of subsequent years. SQM’s Lithium Segment makes up approximately 69% of the company’s overall total revenue, this is revenue share has been rising exponentially since 2021 in alignment with the EV boom.

Source: SQM 2023 Annual Report

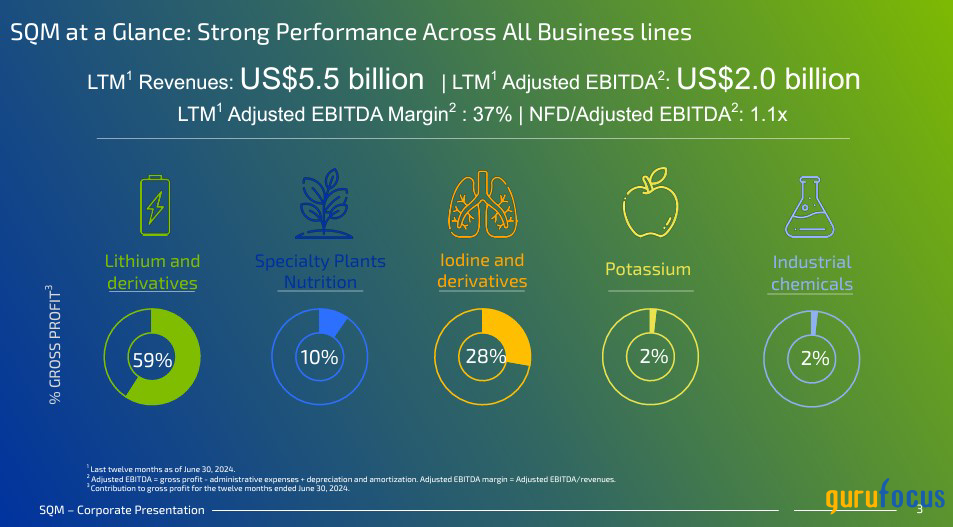

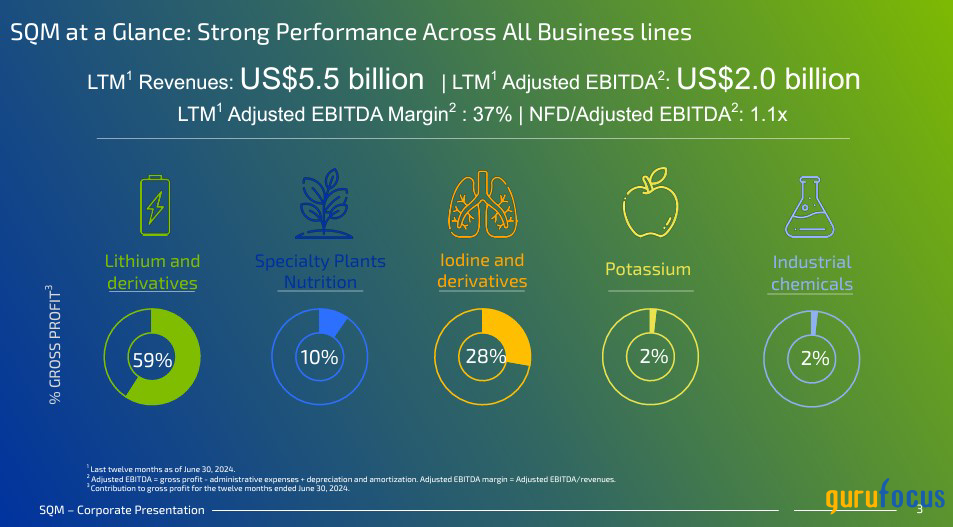

This trend of growing sales volume has continued into 2024 with QoQ sales volume growing exponentially over the last twelve months, sales growth that has been aligned with stabilizing prices. It is by my assessment that these rising sales volumes signal rising demand which should eventually result in lithium prices rising once more. Given that SQM is positioned to have already made $1.1 billion in Gross Profit within the sector over the last 12 months in spite of the falling profits leads me to believe that the company will be well positioned to assume the exponential growth within the segment as lithium prices presumably begin to rise.

Additionally, it can be seen here that prior to 2021, SQM’s biggest revenue stream came from their SPN Segment, but in 2021 they started to see substantial rises in all segments, especially in Lithium, primarily drivenby the EV sector, a trend that has in aggregate continued into current-day.

Source: TradingView.com

At the start of 2024, SQM raised their FY2024 guidance, projecting a higher sales volume of lithium carbonate, (LCE) to 200 Kilometric Tons due to higher than expected Q1 volumes. So far, as of the Q2 report the company has sold 95 Kilometric Tons of LCE, bringing it halfway toward the raised projections, putting it on track to meat, if not beat their goals.

Source Q2, 2024 Earnings Presentation

As reported in the Q2, 2024 report LTM Revenues amounted to $5.5 billion while LTM adjusted EBITDA remained strong at $2.0 billion, during this period, the Net Financed Debt to Adjusted EBITDA ratio sat at 1.1x, representing perfectly safe and acceptable leverage ratio within the company.

In summary, SQM has extensive involvement in the exploration, production, and trade of numerous critical minerals commodities. These commodity minerals are key to the proper function and operation of several key industries spanning across, Electric Vehicles, Consumer and Enterprise Technologies, Renewable Energy, and Agriculture, over the last few years SQM has greatly scaled up their operations, which has allowed them to continuously capitalize on booms as they spanned across differing industries. SQM’s massive internal revenue shift from dominating the in the SPN Segment to then dominating in the Lithium Segment as a result of the EV highlights the company’s ability to adapt to changing economic conditions while also displaying their ability to continue to operate and maintain their high and stale global market share even in other non-boomingsectors.

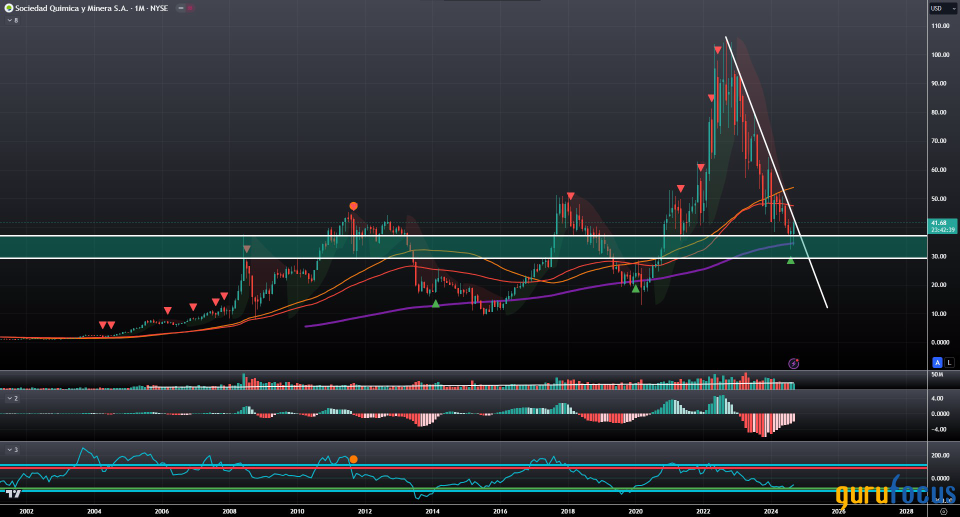

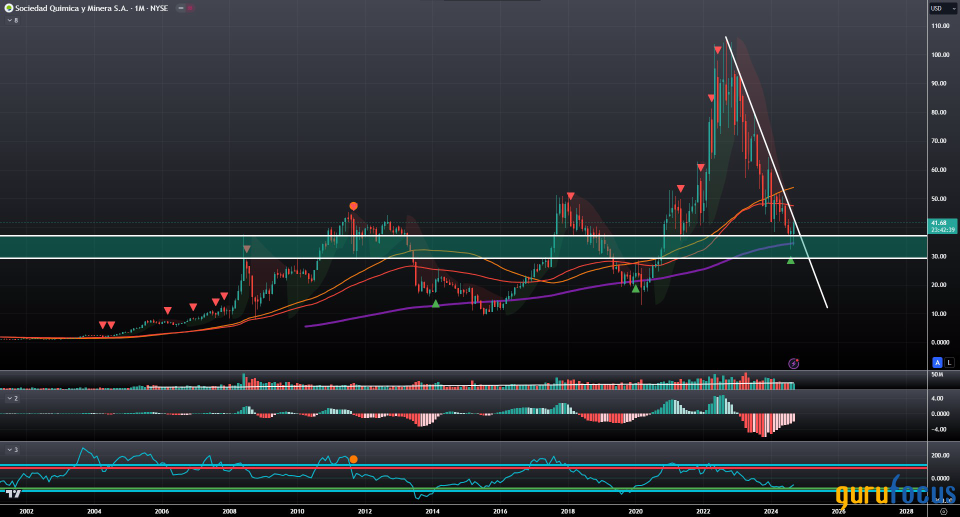

Technical Outlook

Source: TradingView.com

Over the course of the last 10 years we’ve seen SQM enter complete intermittent cycles of exponential growth, followed by subsequent cycles of intermittent cool downs. These cycles have been reflected over the same period in the pricing of the stock through cycles of intermitted rises and declines in share prices. However, the underlying trend throughout all of it has consistently been higher lows and higher highs. The 200-month Simple Moving Average has acted at a bottoming level for this stock during the previous two cycle lows and now as it aligns with a price support/resistance level, the 200-month SMA appears to be acting as support again with negative momentum on the MACD declining, and the PPO Oscillator stagnating at oversold extremes, now pointing upwards and presenting a potential buy signal.

If history is to repeat, we should see shares of SQM begin a new Bullish Cycle, taking it from the current level of $41.68, to reunite with the previous cycle high of $106.16 and beyond.

This article first appeared on GuruFocus.