Democrats are opening the door to collaborating with Republicans on a tax bill as the GOP faces several obstacles on the road to extending President-elect Trump’s tax-cut law.

While it will be tough for Democrats to get anything they want in a GOP tax bill, the narrow Republican majority along with substantial divisions within the conference are making some Democrats hopeful about bipartisanship on tax.

“If this were a party that wanted to negotiate with the minority party, and I’m thinking that the margins are so narrow that under ordinary circumstances they would negotiate with us, there are things that we probably could negotiate about,” Rep. Gwen Moore (D-Wis.), a Democrat on the House Ways and Means Committee, told The Hill Thursday.

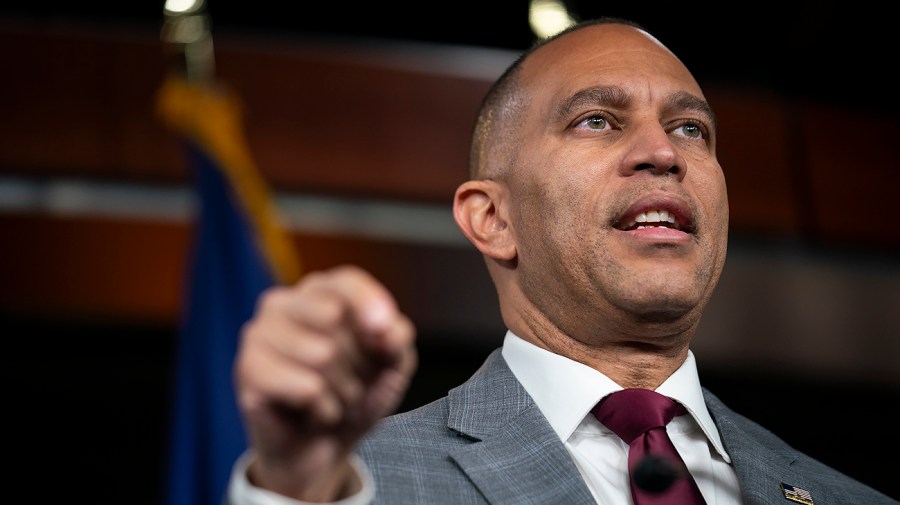

House Democratic leader Hakeem Jeffries (D-N.Y.) also said recently that there could be certain tax issues where his caucus and the GOP could unite behind a measure.

“With respect to certain areas of tax reform … there’s some common ground potentially to be found,” Jeffries told reporters last week.

Republicans are eager to extend key provisions of Trump’s 2017 Tax Cuts and Jobs Act (TCJA), including reductions to personal income tax rates set to lapse at the end of 2025.

While many House Republicans and tax-cut advocates say the GOP should start with a tax bill, GOP senate leadership and some Trump advisers want to kick off 2025 with a border security measure.

The lack of clarity among Republicans and the trickiness of uniting the GOP around a tax bill could threaten attempts to pass a measure along partisan lines through budget reconciliation.

Anything short of near-unanimous House GOP support for a partisan tax bill could force Republicans to work with Democrats on a measure.

There is broad Democratic interest in strengthening the child tax credit (CTC) and the low-income housing tax credit (LIHTC), Jeffries said.

Republican Sen. Josh Hawley (Mo.) proposed a massive expansion of the CTC this week, which would boost the credit from a maximum of $2,000 to $5,000 per child.

His plan would also let parents use the CTC to offset their payroll tax liability along with receiving the credit as regular installments throughout the year, as opposed to in a lump sum during the tax season.

Moore told The Hill that Democrats are also interested in reinstating the research and development (R&D) tax credit for businesses.

A bill to restore that credit passed the House by a wide bipartisan margin as part of a larger piece of tax legislation earlier this year, but didn’t make it through the Senate ahead of the election.

“A lot of Democrats — at least Democrats on the Ways and Means Committee — really are looking at … the R&D credits as a place where we might find some bipartisan support.”

Republicans in Congress are keenly aware of the threat to their tax cuts posed by their narrow majority in the House.

“Everybody’s concerned about that,” incoming Senate Finance Committee Chair Mike Crapo (R-Idaho) told The Hill last week.

“There’s a significant amount of non-TCJA tax policy under consideration. I don’t know whether all of it can get done, but I’m not saying it can’t. We’ll do our best to evaluate all the proposals and fit in as much as we can,” he said.

One particularly thorny issue within the conference that could make collaboration with Democrats an option for Republicans is the state and local tax (SALT) deduction.

The SALT deduction was capped at $10,000 in the Trump cuts, much to the aggravation of many blue state Republicans.

The SALT caucus — the group of Republicans who want to get rid of the cap — includes more than enough members to prevent the GOP-controlled House from passing a bill without Democratic support. That gives the group outsized power to shape a GOP tax bill.

Democratic tax writers are relishing the friction within the GOP conference over what to do about the SALT cap.

“I’m overjoyed with their problem,” Ways and Means ranking member Rep. Richard Neal (D-Mass.) told reporters last week. “They told everybody that it was going to be easy. I told them it wasn’t going to be easy … My prediction is that it won’t be easy.”

Among Trump’s many campaign promises on taxes was a pledge to get rid of the SALT cap.

“I will turn it around, get SALT back, lower your taxes, and so much more,” he wrote on social media in September.

Eliminating the SALT deduction altogether would shrink the deficit by more than $1.6 trillion through 2034, the Congressional Budget Office found earlier this month.

Additionally, Republicans are out of lockstep with each other on the vehicle for their tax legislation, with incoming Senate leadership calling for a reconciliation bill on border security and energy production to be done first, while many representatives in the House insist they want tax to be their top priority.

Despite some shared interests between the parties and enough internal Republican conflict to have Democrats reaching out a hand, disagreements on tax policy abound.

Moore said the 2017 Trump tax cuts amounted to little more than “crumbs from the master’s table” for people making less than $100,000 a year.

Not of interest to Democrats, she said, are the 20-percent income deduction for passthrough businesses and the sped-up depreciation schedule, which allow businesses to write off capital investments up front as opposed to over time.

The passthrough deduction is arguably the top tax priority for Republicans.

Businesses legally classified as S-corporations, LLCs, sole proprietorships, and partnerships — entities that “pass through” their tax liability to their owners as opposed to paying a corporate income tax — have become very common in recent decades.

One study from earlier this year found that “almost half of all private employment in the United States is within businesses that do not pay corporate income tax.” The authors also found that the share of employment classified as passthroughs has more than tripled since the 1980s.

Last year, the IRS established a special unit within its large business and international division specifically to go after unpaid taxes at passthroughs, notably businesses classified as partnerships.